Spire Search Partners reveals market insights in asset management – risk for 3Q 2020.

As we kick off the 4th quarter of a year that has thrown us all for a loop, a new normal (WFH/Virtual Hiring) is crystallizing. Meanwhile, SocGen, JPM, and Goldman are leading the charge back to the office, and a handful of alt funds are following suit.

Everyone is eager to get back to some level of normalcy but is watching closely to see if a surge in Covid cases reverses these little steps forward.

Below are a few updates covering:

- Talent Demand

- Talent Supply

- CRO Networking

- Market Moves

Talent Demand

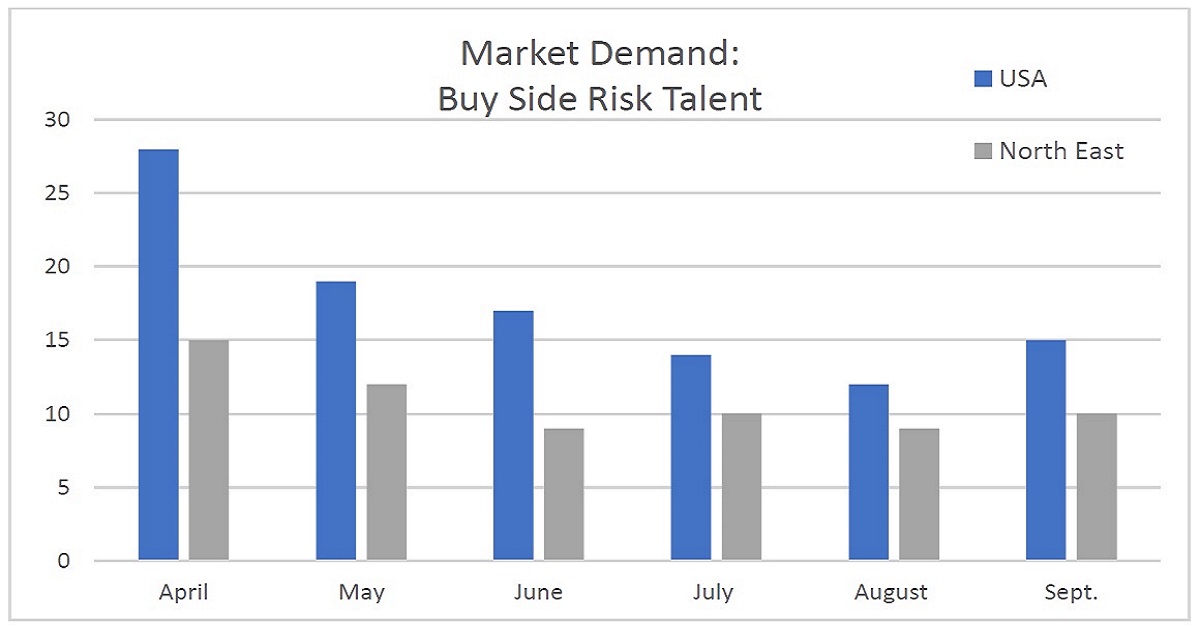

There is a bit of pent-up demand for talent, and hiring is slowly coming back online, though the numbers (see below) are only slightly up. Most firms have gotten comfortable with hiring/onboarding virtually, and most firms have no definite plan to get back in the office anytime soon – as such, we expect to see a quick rise in hiring before year-end.

The only clear demand for talent is coming from the big multi-strat hedge funds (Point72, Citadel, Balyasny, Millennium, ExodusPoint); largely a game of ‘musical chairs’ for PMs and front office talent but certainly trickling down to the risk functions as well, total headcount at these firms shows clear growth. These firms rarely post job openings, so the demand here is not well reflected in the chart below.

We’ve also been hearing about mid to senior-level openings at Invesco, Tudor, Davidson Kempner, and some others. Citibank’s deficiencies in risk and control, recently highlighted by regulators, have already brought about a draw for new talent.

Talent Supply

Industry M&A, underperforming hedge funds, and some sizable firms outsourcing their asset management function are still pushing talent onto the market. Increased market volatility and uncertainty have even the most passive talent open to hearing about opportunities. Private market talent is pretty well dug in, but increased hours in home offices are keeping anyone from spending much time considering outside opportunities.

TIAA’s plan to make sizable cuts to their staff has yet to have a major impact – only 7-10% of those offered a buy out are expected to accept – how this all plays out remains to be seen.

CRO Networking

If you are interested to connect and meet other asset management CROs let me know – we are in the process of assembling CRO peer groups that can leverage the network for best practices, insights, and solutions. Let’s talk. ~ Dennis Grady

Market Moves

- HSBC has announced that Lisa Carbone, Chief Risk Officer of Private Banking Americas is stepping down; she has joined JP Morgan as MD, Head of Risk for US Wealth Management

- Richard Bartholomew, CRO of Northern Trust Asset Management, has transitioned internally to Director International Products

- Bill Schmitt, Head of Fixed Income Risk at Putnam Investments has joined Wellington

- Ping Jiang former Deputy Head of Investment Risk at A|B has left New York Life Investments where he was Head of Investment Consulting to join Qontigo as Head of Multi-Asset Solutions, America

- Vijay Tunikipati formerly the CRO for TIAA Endowments and Philanthropic Services (OCIO) has left to join Infosys BPM as CRO for their Vanguard DC Plan business

- Nora Shettel, the Deputy CRO of Legg Mason, transitioned to Director of Enterprise Risk Management

- Lu Chang, CRO and COO of Angel Oak Capital Advisors, has left to join Axonic Capital as CRO

- ABN AMRO promotes Robert Strandberg to MD, Chief Financial Officer, and Chief Risk Officer, US

- Craig Timm has stepped down as CRO for Ladenburg Thalmann and joined Advisor Group as Head of Internal Audit

- Roger Chen, formerly Chief Risk Officer for NY Life’s Retail Life, Marketing, Retail Annuities, Agency and Services, transitions to Head of Enterprise Risk Analytics and Reporting

- Brad Fischtrom, AIG’s CRO for North America General Insurance, has stepped down to join Ledger Investing (a VC-backed insurtech startup) as COO

- Julia Chu was promoted to Chief Risk Officer for Markel

- Northern Trust promoted Stacey Bolton to SVP, Chief Risk Officer of Corporate and Institutional Services

- Brighthouse Financial promoted Phil Melville to Chief Risk Officer; he was formerly the Head of Credit and Strategy

- Cadence, a digital securitization and investment platform for private credit, has appointed Rohit Bharill as Head of Risk; he formerly served as the Head of Asset-Backed Securities and CLOs for Morningstar

- Citi promotes Humberto Salomon to MD and Global Head of Risk Analysis for ICG

- Dan Doherty, formerly SVP of Digital Payments Business Development for Bank of America is promoted to Chief Risk Officer, Digital Banking and Enterprise Payments