Spire Search Partners reveals market insights in private markets – accounting and finance for 3Q 2020.

As we kick off the 4th quarter of a year that has thrown us all for a loop, a new normal (WFH, Virtual Hiring, video calls) is crystallizing.

Simultaneously, several large banks (SocGen, JPM, Goldman Sachs) are leading the charge back to the office, and a few PE/Alt firms are following suit. Most, however, have no plans of returning to the office until there is a vaccine.

This quarter’s market update highlights several topics we hear from our network of private markets CFOs:

- On the Mind of Your Peers

- Talent Demand

- Market Moves (hirings/firings)

Do you agree? Did I miss anything that should be included?

On the Mind of Your Peers

Process & Tech Transformation

More and more CFOs and their senior support teams say that they are spending most of their time on “process and technology transformation” – while many were bothered that this was taking them away from their “day job” those systems have equipped them to function with fully remote teams and continue to improve efficiencies and scale with growing AUM.

Cost Pressure

The drive to do more with less is ever present; the functions focus on process and systems reflect this but can be at odds with the investments required for new/different technology and talent required to get there. This, too, continues to be a struggle for most CFOs.

Cybersecurity

2019/2020 has the biggest PE firms reinvesting and refocusing on non-financial risk at the firm level. This was reflected in recent hires and promotions at firms like Apollo, Ares, and TPG.

This raises a new priority for CFOs, cybersecurity, which is top of mind for a growing number of C-suite professionals across different functions of major alternative asset managers. A recent report surveying financial services industry CFOs stated that 11% of CFOs now have a dedicated cybersecurity person in their team.

Hiring / Talent Focus

Data and Analytics is a growing focus when it comes to talent requirements/development in the CFO’s world, especially people with the skills to leverage the data and systems that benefited from recent investments, especially in the FP&A function. This is reflected in an increased number of CFOs valuing CS/Engineering degrees and Change Certifications (Six Sigma, etc) just below professional accounting qualifications (CPA) and MBAs.

More and more CFOs say they are either already using or planning some level of AI or Machine Learning applied to their function in the next few years – until then, they are looking for talent with process re-engineering, automation, and system implementation skills to build efficient, scalable processes.

Diversity

Diversity is high on the priority list and getting higher for most PE firms; companies like Vista and Carlyle and some of the other larger firms are strengthening the infrastructure they need to build, retain, and develop diverse talent both in their firms and their portfolio companies. If this isn’t on your radar, it should be.

Returning to the Office

JPM is leading the charge, more and more people (post Labor Day) are eager to get back in the office, but most firms are still reluctant to set a hard date for returning and are waiting to see what happens next – but there is almost NO expectation in the firms we talk to of returning before year-end or even before a vaccine is available.

Talent Demand

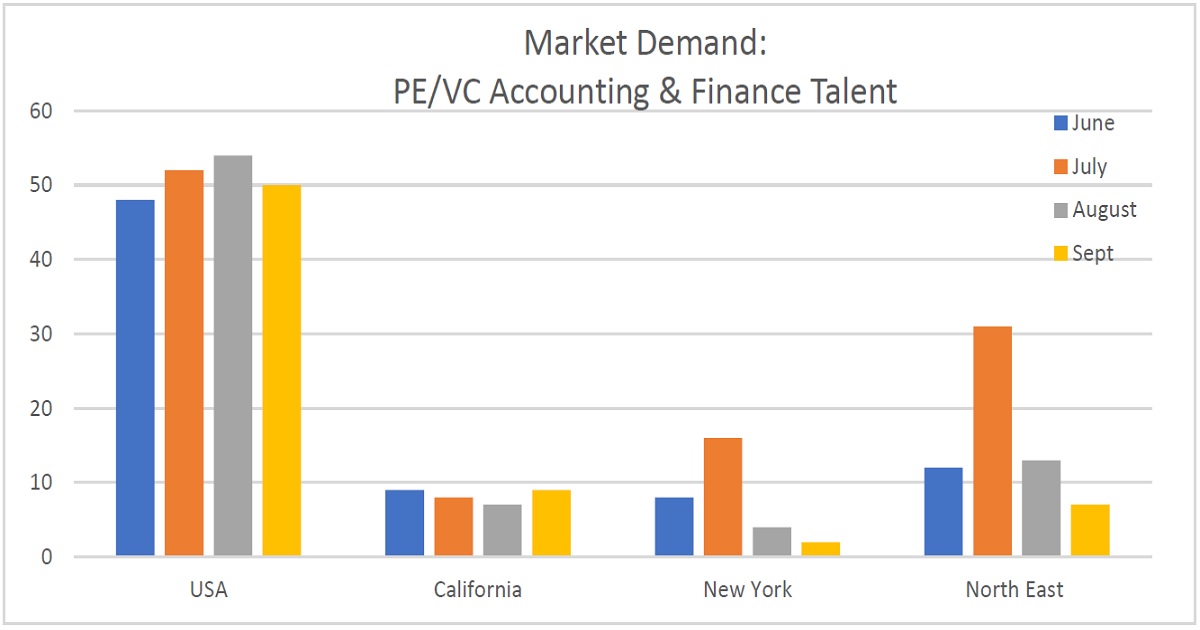

While many private markets and alt asset management firms do not post job openings, we do see clear trends in hiring from those who do, and they reflect what we hear talking to people in the industry.

While firms are getting more comfortable with hiring virtually, all regions/states except California show a continued downward trend in openings.

Market Moves

- Rob MacGoey, formerly Chief Accounting Officer and Controller of Apollo Global Management has joined Harbourvest Partners as CFO, Management Company. He will work alongside Karin Lagerlund, the current CFO, who will focus on client and fund accounting, treasury, and capital markets.

- Lou Tedesco, Partner at American Industrial Partners, transitioned into the CFO role, replacing Stephen Bordes.

- Blackstone appoints Olga Randolph as Audit Director; she joins from JPMAM where she was a VP of Audit.

- General Atlantic promoted Michael Gosk to MD and CFO; prior to joining GA in 2019 as an Operating Partner, he was with GE, serving as a VP and Chief Tax Officer.

- KKR named a new CFO at the beginning of the year following the retirement of Bill Janetschek; he is succeeded by Robert Lewin, who joined the firm in 2004 and has held a number of roles, including PE Investments, helping to launch their Asia business, co-leading the firm’s credit and capital markets business and serving as Treasurer and Head of Corp. Dev.; for the past 2 years he served as Head of Human Capital and Strategic Talent.

- Castlelake has appointed Brad Farrell as CFO; he was formerly the CFO and Treasurer for Two Harbors Investment Corp.

- Shahed Masud joined Apollo as Principal, Head of Valuations, transitioning from Goldman Sachs, where he was a VP leading valuations for PE.

- Shahed replaces Douglas Burrill, who joined PIMCO as SVP, Director of Alternatives Valuations. Doug replaced Sean Donohue, who Doug worked with at Apollo, and who has left PIMCO to join BlackRock as MD, Global Head of Alternatives Valuation Transformation.

- Dina Colombo has left CCMP where she was CFO to become Partner, COO & CFO for GreyLion Capital, Greg Feig has been promoted from Director of Finance to MD, CFO replacing her.

- Joanna Karger, former Funding Circle US Head of Capital Markets joins BFS Capital as CFO.

Earlier this year…

- TPG promoted Kim Whitener to MD, Fund and GP Accounting Services.

- Blackstone promoted Tory Dennerlein to Director & CAO, Global Fund Finance and Corporate Accounting.

- Brandon Fox, formerly Sr. Director – BU Finance, Real Estate for TPG joined Oaktree Capital as SVP – Head of Corporate Accounting.

- Carlyle Co-CEO Glenn Youngkin has retired and will step down, leaving Kewsong Lee as the sole CEO; Kewsong, who served alongside Glenn since 2018, served as Deputy CIO for the firm’s Corporate PE segment and Head of the Global Credit segment.

Did we hit all the right topics and market moves above? Let me know if you have a moment to chat; I’m interested in your feedback ~ Dennis Grady