Spire Search Partners reveals market insights in asset management – risk for 2Q 2020.

Spire Search Partners is proud to have been ranked this year in the “Hunt Scanlon PE Recruiting Power 75”, one of the few firms specializing in Risk and Finance across the private markets (and alternatives more broadly).

Below are a few updates covering:

- Talent Market Trends (supply/demand)

- Market Moves (hiring/firing/promotions)

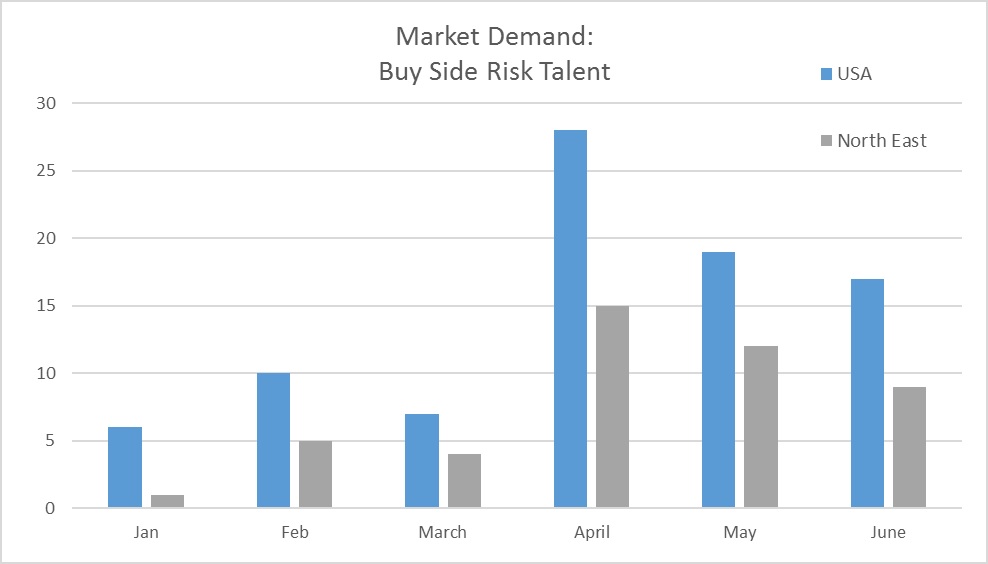

The job post data below shows that 2Q talent demand is much higher than 1Q (though shrinking as the quarter progressed). Yet the market feels to have shifted just in the last month with firms finally getting comfort around what to expect for the rest of the year and settling into their new state of play.

Talent requirements that existed earlier in the year but were put on hold are once again coming to the top of the priority list. I have heard from a few firms that they will endeavor to hire consultants/contractors over permanent hires.

Talent Supply & Demand Factors

Current Administration reducing and freezing H1B Visas is another important factor that will no doubt shrink the already small pool of quantitative/engineering talent that is highly sought after by the tech industry.

Industry M&A in recent years (Invesco/Oppenheimer), restructurings (AQR, Worldquant, BMCM) as well as firm closures/becoming family offices (Paulson & Co) and spotty performance have all pushed risk/quant/port con talent onto the market and has lowered overall demand.

Private Markets teams/firms are, more broadly building out risk and portfolio analytics capabilities – traditionally pretty lean teams, it’s an interesting data point but not a huge driver.

Insurance/Reinsurance continues to drive demand though not as heavily as it had in past years.

Convergence of skill sets (coding skills + market knowledge + communication skills) is what firms are after, yet candidates with all three in equal strength continue to be in short supply.

The current pandemic environment, while becoming somewhat BAU, has far more people, far more passive and not at all open to changing firms – many feel there is too much career risk in being a recent hire in the current atmosphere.

Large diversified financial firms like JPM, who traditionally draw in higher volumes of risk/quant talent, continue to scale back, consolidating teams and shifting functions to other locations (Texas and Southeast) – this lowers demand locally in NYC but has also pushed a fair bit of talent onto the market.

Consultancies from the big 4 to the MBB strategy firms have been growing quant-based risk/analytics and machine learning capabilities, pulling quant risk talent into the fold.

Market Moves

- Steven van Rijswijk, CRO of ING Group promoted to CEO of ING Group; Karst Jan Wolters CRO of ING Wholesale replaces Steve as interim CRO

- Doug Niemann appointed CRO of Athene Holdings, Doug was Sr. MD of Investment Management at Guardian Life; David Ye (CRO) left Guardian in February and Michael Slipowitz became CRO and Chief Actuary.

- Max Roberts joins Shenkman Capital as CRO and Richard Cresswell is promoted to CRO of Highbridge Capital Mgmt.

- Amy Wierenga, former CRO, Head of Portfolio Construction for BlueMountain Capital joins GCM Grosvenor as CRO

- Robert de Veer is promoted to Chief Risk Officer of BlueMountain Capital

- Jasmine Burgess, Brevan Howard’s former Head of Risk in the US joins Coremont US, the firm’s outsourced services unit as Head of US; she is replaced by Aneta Bresliska

- Kristen Walters, former Global Chief Operating Officer of Risk & Quant Analysis at Blackrock, joins Natixis Investment Management as CRO

- Laura Dottori-Attanasio transitions from CRO to Head of Personal and Business Banking for CIBC, Shawn Beber appointed CRO to replace her

- Wells Fargo appoints Kevin Reen (formerly JPM’s Chief Credit and Risk Officer for Credit Cards) as CRO for their Consumer lending arm, reporting to Mandy Norton; Bill Juliano (formerly US Chief Ops Risk Officer for Santander Bank) joins Wells to lead it Ops Risk Mgmt team also reporting to Mandy Norton (Wells is conducting a search for new CROs for it’s Commercial Banking, Consumer & Small Business Banking, Corporate & Investment Banking, and Wealth & Investment Mgmt Businesses)

- PineBridge Investments promotes Michelle Fu to Head of Risk, Americas

- Regions Bank appoints Javier Hernandez as EVP, Head of Non-Financial Risk; he was formerly the CRO for BBVA, Ignacio Carnicero (formerly responsible for the bank’s enterprise risk management) is promoted to CRO to replace him

- Graham Capital promotes Christopher McCann to CRO following the retirement of Bill Pertusi

- Brent Simonich is promoted to EVP, Chief Risk Officer of eTrade