Spire Search Partners reveals talent market highlights in asset management – risk for 1H 2021.

Hiring is off to the races…

The talent market has come screaming back after last year’s Covid-driven hiatus. With plans to get back into the office mostly solidified, and a clear sense of optimism that the worst is behind us, companies have spent much of the first half of 2021 hiring.

We have a broad view of the risk function across a variety of FS firms and across all risk stripes (financial & non-financial) – while search firms of every specialization are busy, the risk talent market has been a major benefactor of this resurgence.

Talent Supply

Return to office and $$$…

Most talent is open to looking at outside opportunities when they aren’t completely swamped with their current role.

The three main factors driving this are:

- Compensation packages are rising – we are seeing guarantees again

- Fading uncertainty in the market post-vaccine

- RTO plans – there are equally as many people in firms moving to remote that want to be in an office as there are those who want more flexibility than their firm allows

Thus far we’ve only seen the “remote only” option being offered by tech/fintech firms. Furthermore, most risk leaders agree that remote-only will minimize career development opportunities, stifle the development of up-and-coming talent, and ultimately hurt company culture.

Many firms are taking unprecedented steps to retain talent using levers like compensation increases, extra bonuses, and WFH flexibility, some even opening new offices in different locales to accommodate dispersed teams. Several IBs are paying out extra bonuses or raising them significantly, and Blackrock has announced a companywide (Director or lower) 8% increase in base salaries.

The front office is enjoying the lion’s share of these comp increases, but the trend is benefiting risk talent as well with strong offers (strong increases, guarantees, signing bonuses) and rising overall compensation. Key strategic risk talent is ‘feeling the love”.

Talent Demand

Everyone is hiring…

Demand has shot through the roof, more heavily in operational risk than in financial risk, but we are seeing demand for all types of risk talent from tech/fintech, insurance, alt, and traditional asset managers.

Buy-side firms of all types are building/bolstering their non-financial risk functions in strategic and commercial ways and looking for ways to better use data to inform strategic business decisions.

In addition to the pent-up demand that was put on hold last year, other demand drivers include:

- Major companies moving risk and other operational functions geographically, creating new requirements/turnover

- Market factors, including ESG, crypto, and “meme stocks” requiring risk coverage

- Traditional asset managers are growing their exposure to alternative assets, including private credit

- Tech/Fintech firms responding to the regulatory issues hitting the industry (Robinhood)

- Tech/Fintech firms building Ops Risk teams to support moves into banking and/or building ops risk frameworks to support regulated FS clients

- Alt & Traditional Asset Managers building non-financial risk functions

- Post M&A Asset Managers restructuring teams or extending/bolstering ops risk functions

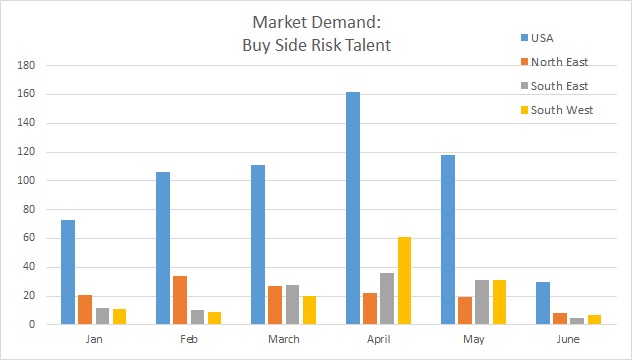

Our job posting data reflects the spiking demand we’ve been seeing firsthand in the market; that said, a vast majority of the job post data we tracked these past few months has been from Wells Fargo and Goldman Sachs.

June shows a rapid drop off but we’ve already seen those stats regaining some ground in July.

Market Moves

- Paul Diouri, formerly Head of Risk – Americas for Schroders joins Barings as Chief Risk Officer

- Chris Van Buren, formerly the EVP and CRO of TIAA has joined Edward Jones as Principal and CRO

- Jacques Longerstaey, the CRO of Nuveen (TIAA’s AM arm), has transitioned to CRO, Financial Risk & Capital Management for TIAA

- Carlyle Group’s Heather Mitchell replaces Bruce Rosenblum as CRO; she is also GC for Investments and Head of the firm’s EMEA region

- Aron Landy, CRO of Brevan Howard transitions to CEO

- Ameriprise Financial has promoted Jeninne McGee from SVP, Operational Risk & Data Governance to EVP and Chief Risk Officer

- Giuseppe Paleologo, Head of Enterprise Risk for Millennium has joined Hudson River Trading as Head of Risk Management

- Tony Mongey the former Head of International Operations and Risk has left Eaton Vance

- Franklin Templeton has promoted Benjamin Seidlich from VP, Investment Research and Data Management to SVP, Co-Head Investment Risk

- Torben Ostergaard the former EVP and Chief Risk Officer of USAA has left and joined Spinnaker Insurance Company as President and CEO

- Neeraj Singh the former CRO of US Consumer Bank and Head of Consumer Risk Modeling at Citi has joined USAA as EVP, CRO

- Benjamin Perlman, formerly Chief Credit Officer and Investments CRO for Genworth Financial joined ORIX Corp. as MD – ERM

- Richard Cresswell, the CRO of Highbridge Capital has joined Citadel as Head of Credit, Converts, Vol Risk

- Ying Murdoch, formerly Head of Quant Risk Analytics – Investment Risk for MassMutual has joined Columbia Threadneedle as Head of NA Fixed Income Risk

- Melissa Sexton formerly, MD and Co-Head of Field Risk and Supervision has joined BNY Mellon Wealth Management as CRO

- Abe Riazati former Head of Investment Risk – Global FI for Morgan Stanley Investment Mgmt. has joined American Equity as Head of Investment Risk

- CommonFund promoted Brian Rondeau to CRO

- Apollo GM appoints Courtney Garcia at MD, Head of Market Risk, she joins from PIMCO where she was EVP of Risk Mgmt.

- Natixis Inv. Mgmt. appoints Hyung Kim as SVP, Global Head of Investment Risk

- HSBC has promoted Bhoomi Gandhi to Head of Risk, US Wealth Mgmt

ORM / ERM

- AQR’s Graeme Farrell, Global Head of ORM and Resiliency has stepped down and joined Interactive Brokers as Group CRO

- Lincoln Financial Group has promoted Jonathan Martin from VP, Head of ERM, Actuarial Risk, and Investment Risk Analytics to SVP of ERM

- Chris Chao, Americas Head of ORM and ERM for DWS joins Rockefeller Capital Management as Head of Risk Management

- GSAM’s Head of ORM, Nicholas Goupee has left to join BlueVine as Sr. Director, Banking Risk Operations

- Sylvia Arnardottir is promoted to Vanguard’s Europe Head of ORM

- Coinbase appoints Kevin Feig as Head of ERM, he joins from Fidelity where he was VP of ERM

- Natixis Inv. Mgmt. appoints Kristin Borowski as Director of ORM, she joins from Manulife

- Morgan Stanley Private Bank’s Head of ORM and Compliance has stepped down and joined SMBC